Everbridge Enhanced Critical Event Management and Sustainability reporting

- World Climate Foundation

- Nov 20, 2023

- 9 min read

Noah Webster, General Counsel; Rachele Gianfranchi, Director Public Affairs; Brendan Ng, Specialist Urban Resilience, Everbridge

In this article Noah Webster, Rachele Gianfranchi and Brendan Ng shares the importance of resilience in the face of global challenges, with Everbridge positioned at the intersection of CEM, ESG, and sustainable finance to offer adaptive solutions.

Build Resilience is one of the four fundamental Marrakesh principles for global cooperation emerged from the IMF and World Bank meetings preluding this year’s COP28. The leaders of the Bretton Woods institutions expressed their understanding of the major risks and disruptive forces facing the global economy “the existential threat posed by climate change, growing disparities in income and opportunity, and geopolitical tensions are intensifying. Rapid digitalization and technological transformations create new challenges, but also opportunities, and no country should be left behind.” (IMF, 2023)

Everbridge thrives on digital transformation, increasing its focus on the intersection of critical event management (CEM), ESG and sustainable finance principles, to create adaptive resilience solutions needed to face companies’ increased risk exposure (World Climate Foundation, 2023 interview to Everbridge CEO). Climate risk, for instance, is seen as one of several “critical failings in the financial system requiring a long-term approach to generate sustainable economic growth”. (Fink, 2022)

As a leading critical event management software technology firm, the importance of integrating sustainability and ESG considerations into CEM strategies is a priority. Everbridge’s mantra being one of Keeping People Safe and Businesses RunningTM, the company prides itself of doing business as a corporate citizen, servicing those customers and partners who are using its technology to ensure the physical security of their staff and assets at 360 degrees, year after year, with up to 95% customer retention rates. Everbridge customers include some of the largest firms and leaders in their respective industries, including Fortune 1000 businesses such as Bristol Myers Squibb, Cisco, CVS Health, Goldman Sachs, Tiffany & Co., and insurance providers like Anthem, chemical giant Dow, and telecom consumer electronics company Nokia, as well as ome of Silicon Valley’s leading tech giants, global e-commerce firms, streaming media services, oil, and natural gas providers, hotel and hospitality chains, automotive, courier delivery, aerospace and defense technology, air travel, and major car rental firms.

Building on research by Global CEO Program (Deloitte, 2022) and summarized in our recent Empowering Resilience and Board Governance Webinar, “knowing the risks, doing risk assessments and mitigating them” are the key challenges companies and their boards are facing today. Not purely challenges, these are opportunities for companies who can seize them, to evolve in a sustainable manner responding to their global stakeholders, within the limits of planetary resources.

On this basis Everbridge establishes a total resilience approach, maturing our own resilient posture as well as supporting our customers in establishing measures to measure, report, and manage their exposure to risks, as well as recovering from operational disruptions. Measured benefits of aligning CEM practices with sustainable finance principles, fostering resilience, and enhancing long-term value for organizations and communities are growing (Verdantix, 2022). Appropriately leveraging the functionalities expanded by artificial intelligence, companies that can leverage science-backed, high-quality data to manage and explain their sustainability performance will be rewarded with competitive advantages such as access to new sources of green finance, increased market share, enterprise value and protection from greenwashing accusations (ERM, 2023).

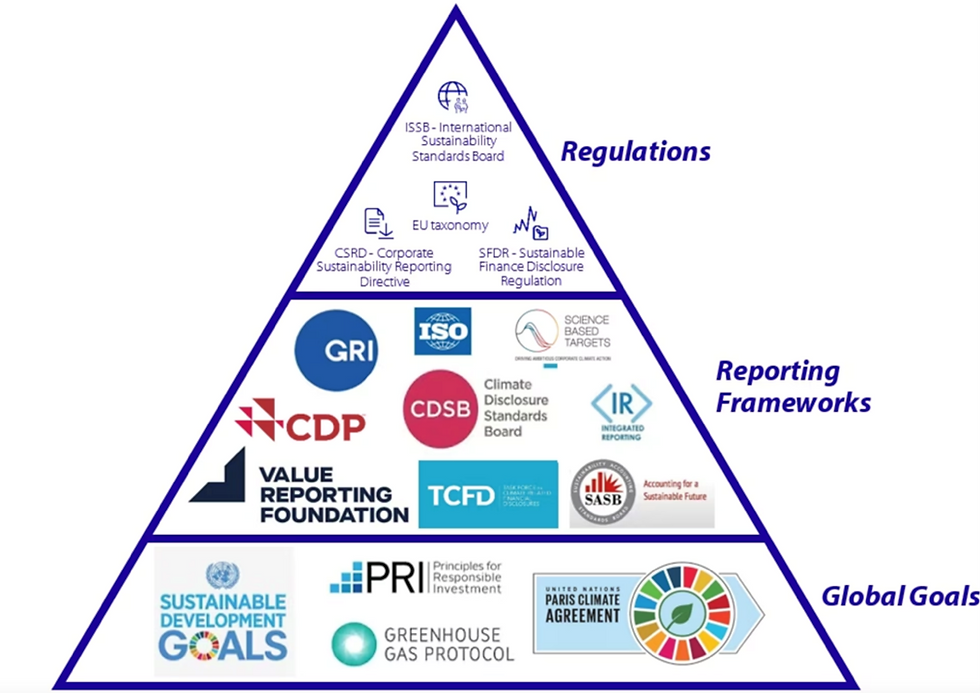

Converging Regulatory environments Support Global Companies’ Reporting Opportunities

The increase in sustainability reporting requirements is converging, driven by new laws and regulations emerging in the EU, the UK, the US, as well as Asia Pacific. Such regulatory frameworks respond to a growing understanding in the finance sector of the power ESG issues have in impacting financial performance and corporate value beyond the short term. Such standards are intended to meet the information needs of the capital markets and function as a starting point for securities regulators around the world that choose to adopt them to advance their rulemaking (RaboResearch, 2022).

The opportunity is not only environmental, technological, or social, it is all three simultaneously. All are required to ensure knowledge of what affects an entity’s cash flows, access to financing, access to insurance, and cost of capital over the short, medium, or long term growth, for a sustained and sustainable capitalistic economic model. In this context, existing standards have increased in usage and are increasing consistency in ESG data reporting globally, both at corporate and government level, driven by the search for better long-term financial value, and a pursuit of better alignment with values (OECD, 2022).

Sustainability reporting is now so nearly universally adopted that companies not yet reporting will find themselves rapidly out of step with global norms. Many jurisdictions, as in the draft US Securities and Exchange Commission (SEC) climate disclosure, are increasingly asking climate-related financial reporting in line with the Taskforce on Climate-related Financial Disclosures (TCFD) recommendations, created in 2015 by the G20’s Financial Stability Board (FSB).

In the UK, premium-listed companies have been required to report on a “comply or explain” basis on whether their disclosures meet the recommendations of the TCFD since 2021, a requirement extended to standard- listed companies the following year. Similar global mandatory disclosure requirements may eventually apply in the use of the new Taskforce on Nature-related Financial Disclosures (TNFD), released in September 2023.

This year 2023, the International Sustainability Standards Board (ISSB) inaugured standards IFRS S1 and S2 which converge with the 12 European Sustainability Reporting Standards (ESRS) of the EU Taxonomy to cover specific disclosure requirements for sustainability (including environmental, social, and governance matters). The mandatory assurance introduced by the EU (European Union) Corporate Sustainability Reporting Directive since 2023 adds more requirements to ensure greater granularity for numerous Everbridge customers headquartered or operating in the 27 countries (Greenomy, 2023). Notwithstanding the national specificities, also firms across Asia Pacific expect the ISSB standards to be mandated by several jurisdictions by 2025 and that many larger listed companies will voluntarily adopt them from as early as 2024 (Deloitte, 2023).

As mentioned by our CEO, David Wagner:

“Under the oversight of our Board of Directors, we have taken important steps to refine our own approach to sustainability by enhancing disclosure pertaining to ESG and developing new policies and processes to align our strategy and operations with key sustainability principles. We are also exploring ways to use our proprietary technology to gather and analyze alerting trends, which can enable us to identify the environmental risks that are most likely to impact the safety of our employees”.

- David Wagner, CEO Everbridge

In 2023 Everbridge made disclosures under the Task-Force on Climate-Related Financial Disclosures (TCFD), together with the SASB Software and IT Services sector frameworks, while contributing to Sustainable Development Goals. In addition, Everbridge has developed the Best in Resilience certification program, which evaluates and benchmarks resilience preparedness consistently with established industry frameworks.

The Corporate Champions Context

Perhaps due to the stringent regulatory environment (European Commission, 2023) in the Race to Zero that emphasizes sustainability, data privacy, and consumer rights, EU-based companies have been early adopters of sustainability initiatives such as “Fit for 55” or the Corporate Leaders Group Europe, 2023) shaping their external-facing value proposition and purpose marketing. Renewable energy usage, circular economy practices, and carbon neutrality commitments are becoming the distinguishing factors of best performers such as: in the tech environment: SAP, Siemens, Vestas, Schneider, Novozymes, as well as Bouygues, Atos EcoAct (Sustainabilitymag and Businesschief, 2023). Among these, 60+ companies and investors worth $651bn supported the EU in agreeing to ambitious sustainability reporting standards (CDP, 2023). Some US-based tech giants (Nvidia, Meta, IBM, Keysight, Cisco, Apple) have also taken leadership positions in sustainability, setting ambitious goals related to renewable energy use, supply chain transparency, and social impact. This is happening under increasing pressure from investors, including ESG-focused funds and socially responsible shareholders, increasingly asking to improve reporting on their CSR and ESG performance.

Aligning CEM with ESG and sustainable finance reporting involves comprehensive risk assessments that consider not only financial but also physical risk correlated to environmental and social disruptions. The complexity is unprecedented, and the right data is essential. For example, the CSRD asks for 1,300 data points, which will require new information to be identified, collected, and processed from across the whole business and wider supply chain (Deloitte, 2023). This comprehensive approach enables governments and organizations to identify vulnerabilities and prioritize resilience-building efforts, provided they have the appropriate technology to measure and track such data. The Intersection of CEM and Resilience: facilitating integrated risk management through data collection and reporting Everbridge 360 offers the most comprehensive CEM risk data to Keep People Safe and Organizations running TM by enhancing risk monitoring, communication, reporting, and recovery management. This is where the insights deriving from an integrated use of Everbridge critical event management technology can help measure, monitor, reduce risk, especially of a physical nature. The resiliency is induced by enabling corporates to demonstrate the adopted processes for monitoring and identifying issues, and producing the documentary evidence with which the company is addressing the risks they are disclosing. This gives you assurance that when you disclose a resilience-related risk in your Sustainability Report or public filings that you have a system for monitoring and addressing the risk event should it occur—stated another way, you have an answer should certain greenwashing allegations arise. In addition, CEM is facilitating four other key operational tasks, as described below.

1. Alerting and Monitoring is Enhanced Risk Management

Critical events, including natural disasters, cyberattacks, and pandemics, pose significant risks to organizations and society at large. Effective, timely communication of critical events is essential to decouple economic growth from climate risk- associated costs, for instance to ensure business continuity, as well as to keep people safe. By powering the nation-wide mobile early warning systems in 25 countries globally, Everbridge is contributing to SDGs 11 and 13.

2. Empowering Data Collection Facilitates Risk Assessments

Everbridge can empower organizations to collect longitudinal data on alerting within its proprietary CEM tool. This data can be used to identify at-risk assets more effectively, particularly as those risk profiles may begin shifting more quickly due to climate crisis. Additionally, business continuity and security teams can save time that would have otherwise been spent collecting this data manually and rededicate it to higher value work.

3. Data Necessary For Resilience Planning

Sustainable finance principles encourage organizations to invest in resilience measures that protect against critical event impacts. Integrating sustainability reporting aspects and data into CEM leads to more robust contingency plans, incorporating green infrastructure, and promoting community safety and well-being. By providing a software portfolio of systems which support more than 6,000 companies and organizations in managing their resilience planning and diverse human capital, Everbridge is contributing to SDGs 5 and 10.

4. Working Together Requires Stakeholder Engagement

Engaging stakeholders, a key tenet of sustainable finance, is critical in CEM. Collaboration with local communities and authorities enhances preparedness and response, fostering a sense of shared responsibility. By playing an active role as a sector member of the ITU and UNDRR, Everbridge contributes to SDG 17.

Conclusions

Integrating sustainable finance principles into critical event management is an imperative step for organizations aiming to build resilience, mitigate risks, and create long-term value. By aligning their CEM use with the sustainability reporting standards, businesses can strengthen their capacity to navigate critical events while contributing to a more sustainable future.

About Everbridge

Everbridge (Nasdaq: EVBG) empowers enterprises and government organizations to anticipate, mitigate, respond to, and recover stronger from critical events. In today’s unpredictable world, resilient organizations minimize impact to people and operations, absorb stress, and return to productivity faster when deploying critical event management (CEM) technology. Everbridge digitizes organizational resilience by combining intelligent automation with the industry’s most comprehensive risk data to Keep People Safe and Organizations Running™.

For more information, visit https://www.everbridge.com/, read the company blog, and follow on Twitter.

Everbridge… Empowering Resilience.

About Noah F. Webster

Noah F. Webster is Chief Legal & Compliance Officer and Corporate Secretary at Everbridge. He is responsible for leading and managing all legal, compliance, and risk management programs at the company. Noah has over 20 years of legal experience, including negotiating agreements, security, compliance, litigation, and M&A. Noah previously served as a public tech company Chief Legal & Compliance Officer and held various positions within a corporate legal department, such as Division General Counsel and Head of Global Compliance.

About Brendan Ng

Brendan Ng is a Senior Resilience Consultant at Everbridge. He helps organizations and governments better understand, quantify, and communicate the value of building resilience through Everbridge solutions. He also manages Everbridge’s sustainability program, aligning company operations with Sustainable Development Goals.

About Rachele Gianfranchi

Rachele Gianfranchi is Director for Government Affairs at Everbridge. In the last 20 years she built her experience working for the EU Commission, The World Bank’s IBRD, and running a Brussels-based advisory firm. Her policy and regulatory expertise have been in telecom regulation and digital, including AI, climate.

References Deloitte (2023), Sustainability technology is a necessity https://www2.deloitte.com/nl/nl/pages/sustainability/articles/sustainability-technology-is-a-necessity.html Deloitte CEO Program Research (2022), How the CEO’s leadership in digital transformation can tip the scales toward success https://www.deloitte.com/an/en/our-thinking/insights/topics/business-strategy-growth/leadership-in-digital-transformation.html Deloitte (2023), Asia Pacific's Response to the International Sustainability Standards Board (ISSB)'s Finalised IFRS S1 and IFRS S2 Standards https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/audit/sea-aud-apac-response-to-the-finalised-issb-ifrs-s1-and-ifrs-s2-standards.pdf ERM (2023), CFO Briefing https://www.erm.com/insights/cfo-briefing-responding-to-sustainability-disclosure-requirements/ European Commission (2023), Questions and Answers on the Adoption of European Sustainability Reporting Standards https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043 Everbridge (2023), 2023 Sustainability Report https://ir.everbridge.com/static-files/d4789d5c-bc43-4527-b773-5cee971ce6d8 Fink, L. (2022), Letter to CEOs: The Power of Capitalism https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter Greenomy (2023), The ISSB and the ESRS: What we know so far, https://greenomy.io/blog/issb-esrs IFRS Foundation (2023), Foundation welcomes culmination of TCFD work and transfer of TCFD monitoring responsibilities to ISSB from 2024, https://www.ifrs.org/news-and-events/news/2023/07/foundation-welcomes-tcfd-responsibilities-from-2024/

IMF Media Relations (2023), Press Release https://www.imf.org/en/News/Articles/2023/10/11/pr23345-statement-world-bank-imf-morocco-on-the-marrakech-principles-for-global-cooperation

KPMG, Survey of Sustainability Reporting at Technology Companies, 2022 https://assets.kpmg.com/content/dam/kpmg/se/pdf/komm/2022/Global-Survey-of-Sustainability-Reporting-2022.pdf , https://kpmg.com/us/en/articles/2022/tmt-sustainability.html

Rabobank Research (2022), An introduction to the sustainability reporting landscape https://www.rabobank.com/knowledge/d011294242-an-introduction-to-the-sustainability-reporting-landscape

Verdantix (2021), Navigating Climate Threats and Proactive Mechanisms to Achieve Business Climate Resilience, https://go.everbridge.com/verdantix-navigating-climate-threats-and-proactive-mechanisms-reg-page.html

World Climate Foundation (2023), The Path for Climate Adaptation, Interview to Everbridge CEO https://www.worldclimatefoundation.org/post/the-path-for-climate-adaptation-everbridge-ceo-interview

コメント